utah fast food tax rate

The state sales tax rate in Utah is 4850. Multiply line 1 by line 2 4.

The tax reform package would increase the states portion of the sales tax on food from 175 to 485.

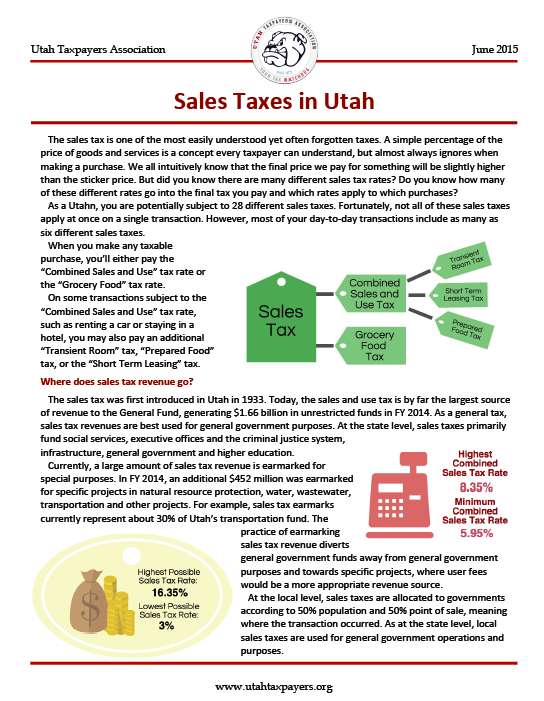

. With local taxes the total sales tax rate is between 6100 and 9050. Used by the county that imposed the tax. 91 rows This page lists the various sales use tax rates effective throughout Utah.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families. This is the Connecticut state sales tax rate plus and additional 1 sales tax.

Wayfair Inc affect Utah. An earlier version in one reference reported Utahs sales tax rate as 495. Select the Utah city from the list of.

The County sales tax rate is. Utah lawmaker Rosemary Lesser is leading the cause to eliminate sales tax from food purchases. Theres a 175 tax on unprepared foods like what you would buy in the grocery store.

Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food. The Lehi Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Lehi local sales taxesThe local sales tax consists of a 080 county sales tax a 100 city sales tax and a 025 special district sales tax used to fund transportation districts local attractions etc. With local taxes the total sales tax rate is between 6100 and 9050.

Utah has recent rate changes Thu Jul 01 2021. Utah UT Sales Tax Rates by City. The Orem Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Orem local sales taxesThe local sales tax consists of a 080 county sales tax a 110 city sales tax and a 025 special district sales tax used to fund transportation districts local attractions etc.

Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales. OF COLUMBIA 6 -- indicates exempt from tax blank indicates subject to general sales tax rate. Multiply line 4 by 3 03 6.

The Salt Lake City sales tax rate is. Both food and food ingredients will be taxed at a reduced rate of 175. Pushed them to lower the tax more than a decade ago.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. See Utah Code 59-12. In the state of Utah the foods are subject to local taxes.

This is the total of state county and city sales tax rates. The correct rate is 485. Download all Utah sales tax rates by zip code.

Compiled by FTA from various sources. Sales Tax Breakdown. Credit for sales tax paid to another state on use tax purchases.

Use tax rate decimal from Use Tax Rate Chart X. Location Code Sales and Use Food Room Restaurant Leasing Exempt Beaver County 01-000 635 300 1092 735 885 Beaver City 01-002 735 300 1192 835 985. Like lotteries state taxes on food amount to a tax on the poor.

The restaurant tax applies to all food sales both prepared food and grocery food. UTAH 61 5 30 5 VERMONT 6 VIRGINIA 53 2 25 2 WASHINGTON 65 WEST VIRGINIA 6 WISCONSIN 5 WYOMING 4 DIST. The Orem Sales Tax is collected by the merchant on all qualifying sales made within Orem.

Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals sold by eating establishments caterers or grocery stores is 735. Many lawmakers have been itching to do this for years virtually ever since former Gov. But it was a gross miscalculation of the publics wishes.

Did South Dakota v. Tax years prior to 2008. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. Exact tax amount may vary for different items. See the instruction booklets for those years.

The group has advocated for restoring the full sales tax on food and lowering the income tax rate. Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. Add line 3 and line 5 7.

To find out what the rate is in your specific county see Utahs tax guide. The Utah sales tax rate is currently. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Report and pay this tax using form TC-62F Restaurant Tax Return. January 1 2008 December 31 2017. It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by retail.

Worksheet for Calculating Utah Use Tax. Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005. Currently food is taxed in two ways.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. See Utah Code 59-12. Amount of purchases except grocery food subject to use tax 2.

According to the US. Theres a 485 tax on prepared foods like what you get in a restaurant. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

January 1 2018 Current. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Utah Restaurant Tax.

Thats about 409 in state sales taxes more a year equalling about 640 a year if she spends 1100 a month on. Amount of grocery food purchases subject to use tax 5.

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Sales Tax On Grocery Items Taxjar

Utah Sales Tax Small Business Guide Truic

Is Food Taxable In Utah Taxjar

Utah Sales Tax Information Sales Tax Rates And Deadlines

Crespo Fast Food Restaurant Elementor Template Kit Fast Food Restaurant Food Fast Food

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Soda And Fast Food Lobbyists Push State Preemption Laws To Prevent Local Regulation

Corporate Tax Rates By State Where To Start A Business

Tax Flyers Tax Prep Accounting Services Tax Preparation

Salt Lake City Utah S Sales Tax Rate Is 7 75

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Free Online 2018 Us Sales Tax Calculator For 89448 Zephyr Cove Fast And Easy 2018 Sales Tax Tool For Businesses And People From 89448 Z Sales Tax Topeka Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Phototipthursdays Sales Tax Last Week I Had Some Questions About Taxes Do Photographers Need To Pay Sales Tax Photographer Needed Photo Utah County